Does Property Owners Insurance Provide Insurance Coverage For Water Damage? A common flooding plan will certainly cover architectural damage, including damages to the furnace, water heater, ac unit, flooring surface areas (carpets and ceramic tile) and debris clean-up. However rainwater that causes flooding would certainly not be covered, nor would rain that enters through a pre-existing opening in your home. Guaranteeing you understand the protection available to you based on the scenarios is essential. You might have a plan for water damage however need to examine your plans and file your insurance claim correctly, consisting of meticulously recording the cause of your damaged framework and materials. In most cases, your dwelling and personal property insurance coverage will certainly spend for water damage arising from snuffing out a fire.

- While a homeowners plan covers water damages in a lot of cases, it's important to comprehend which situations are covered under your plan and scenarios in which your case might be denied.Actually, the normal home owner's policy just covers water damages under really limited scenarios.It's important to keep in mind, however, that a few of one of the most common reasons for foundation damages are typically left out from standard house owners insurance plan.All typical property owners insurance policies consist of personal property protection.Nonetheless, you may need to defend your payout also if damage takes place as a result of a covered event.

My Lorry Was Submerged In Flood Water Will The Damage Be Covered By My Vehicle Plan?

However as the hazard of wildfires has actually expanded over the last few years, several carriers began excluding wildfire damage from the policies they issue. Others have actually stopped insuring homes situated in locations prone to wildfire damage entirely, or have actually increased premiums to represent this raised threat. It's likewise essential to keep in mind that several home owners insurance policies carry a separate deductible specifically for storm damages-- particularly in areas vulnerable to storms. If mold was brought on by a protected event, after that mold removal and removal might be covered by your house owners insurance plan. This might consist of mold and mildew triggered by a burst pipe or other abrupt, accidental discharge of water. Furthermore, your homeowners insurance coverage will certainly not cover vehicle burglary. That being stated, if you have individual items in your car and those Depreciation issues products are harmed or ruined, after that the personal valuables coverage of your house owners insurance coverage will commonly cover them. The components of your home are not covered under a basic flood policy, but for an extra premium, you also might buy flooding coverage for as much as $100,000 of damage to your personal effects.Personal Flooding Insurance

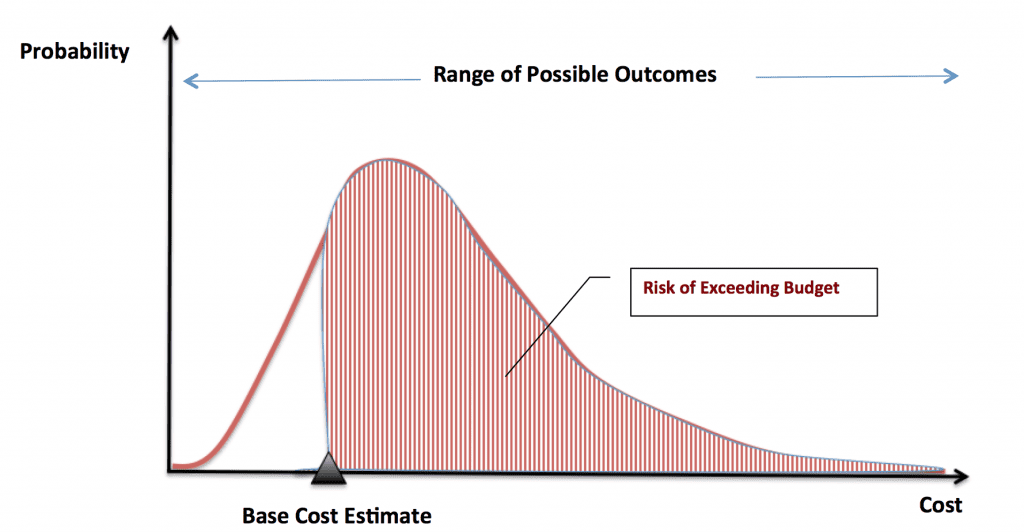

Thinking about the potential price of fixing or restoring your home after a flood, this is a small price to spend for satisfaction. Even if you're not in a risky flood zone, flooding insurance is still a beneficial financial investment. More than 20% of all flooding insurance policy asserts originated from properties situated beyond high-risk flood zones, indicating that even homes in moderate- to low-risk areas can experience flooding.Exactly How To Inspect If You Need Flooding Insurance Policy

A sump pump may aid minimize the risk of water damage from taking place in your cellar. Some property owners insurer provide a separate endorsement for discharge or overflow from a sump pump, which might cover the fixings to your damaged cellar. While insurance coverage generally does not cover flood damages, your homeowners plan might consist of protection for a burst pipe or leaking roof covering.Why is flooding insurance policy not included in a standard homeowners insurance coverage?

The primary reason flooding insurance policy is not included in basic home insurance coverage is the essentially various danger evaluation. Flooding is a local occasion that can trigger considerable damages to homes in specific locations while saving others.